HOW I RUN PERFORMANCE MARKETING

I’ve owned paid acquisition end-to-end across Meta, Google, and programmatic platforms, managing both strategy and execution. My primary goals were run simultaneous DTC/B2B campaigns while focusing on repeat seasonal orders and reducing CAC.

THE CHALLENGE

The client possessed significant market share for custom and/or personalized golf towels within the promo industry. The goal of this campaign was to expand marketing efforts direct to consumer as well as to pro shops and country clubs to make unique items for their business. I’ll be using example figures, audiences, and other assets as I walk through the project.

CONSIDERATIONS

Campaign Structure & Strategy: I focus on the full lifecycle rather than just top-of-funnel clicks. I split my funnel into 3 parts: Top (Awareness), Middle (Consideration), Bottom (Conversion).

Focus On Seasonal Repeat Orders: Will both DTC and B2B audiences order again? Which is more likely?

CAC Reduction: Setting up and testing multiple ad sets and ads upfront helped us quickly find our messaging

3 Metric Levels: Platform, Funnel, Business

CAMPAIGN STRUCTURE & STRATEGY

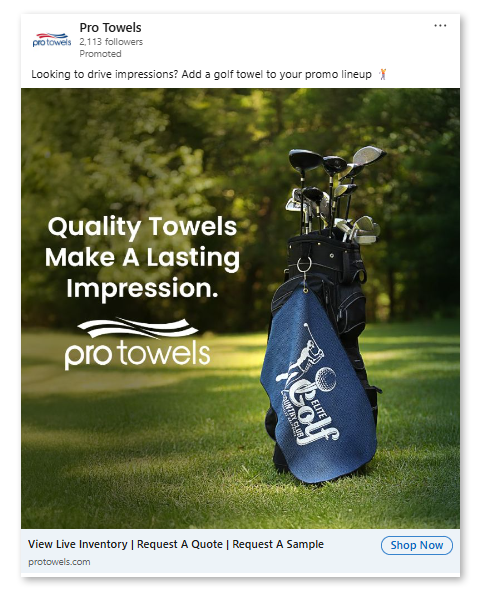

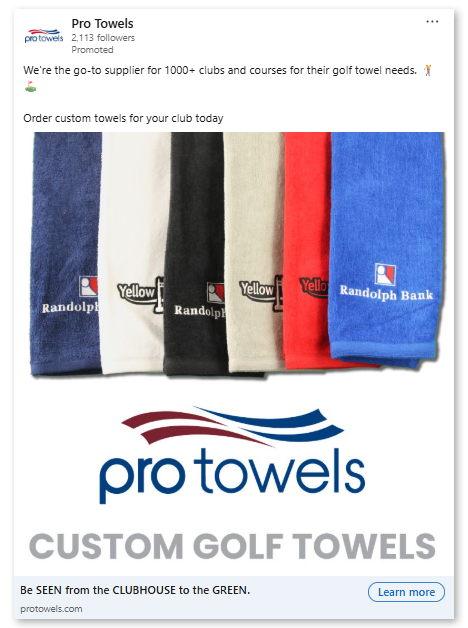

For this Performance Marketing case study, the client had strong market share in golf towels among promotion product distributors. The goal of this campaign was to expand the personalized golf towels direct-to-consumer (DTC) as well as to pro shops and country clubs that wanted to retail branded items (B2B).

TOP FUNNEL (AWARENESS)

Two unique audiences were part of this campaign. DTC and B2B.

AUDIENCE 1: GOLF ENTHUSIASTS

Individual golfers that want to personalize their golf towel. They buy in small quantities (<12) and are motivated by identity, quality, style, and gifting.

Lookalike Audience (Meta)

Previous golf towel orders not tied to a distributor, bulk order, or pro shop

Interest + Behavioral Targeting (Meta)

Golf Brands & Media

Golf Activities (Driving Range, Equipment, etc.)

Golf Retailers

Search (Google)

‘golf towel’ + personalization keywords (gift, custom, etc.)

Google Performance Max

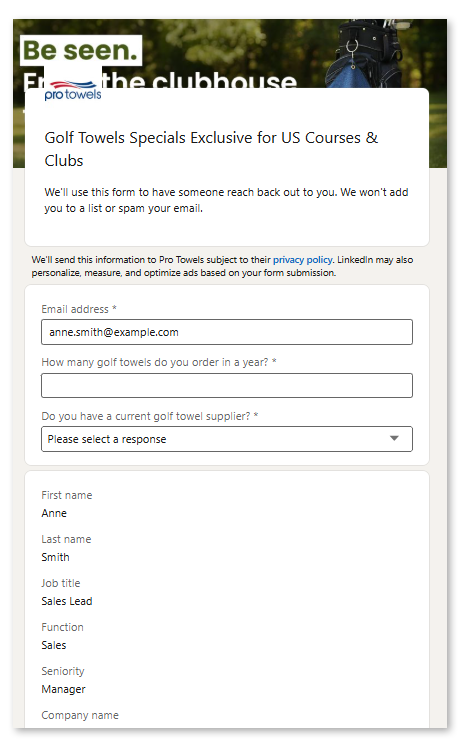

AUDIENCE 2: PRO SHOPS

Club pros, managers, owners, and buyers who work directly with or for country clubs and pro shops around the country. They order 48+ pieces at a time and shop on price and differentiation.

Job Title + Industry Targeting (LinkedIn)

Titles: Club Manager, Director of Golf, etc.

Industry: Hospitality, Recreation, Sports

Matched Audience (LinkedIn)

Third-party data of U.S. Country Clubs and main contact

Interest + Admin Role Targeting (Meta)

Golf AND Small Business Owner OR Club Manager OR Retail Management

Page Admins

Lookalike Audience (Meta)

Previous golf towel orders tied to bulks order or pro shops

Search (Google)

‘golf towel’ + wholesale keywords (bulk, wholesale, etc.)

MID FUNNEL (CONSIDERATION)

Consideration was split into 3 segments (Low, Mid, High) and weighted as well as by Audience.

Low Intent (Early Consideration)

Website visitors

Social and video engagers

Paid search clickers

Goal: Retargeting to encourage return visits

Mid Intent (Active Evaluation)

Product and customization page viewers or 4+ page viewers

2x site visitors

Goal: Push to submit design or fill inquiry/quote form

High Intent (Purchase-Ready)

Cart and checkout starters

Design saves and quote starters

Pricing page visitors

Goal: Automated Hubspot abandonment campaigns and limited-time incentives

BOTTOM FUNNEL (CONVERSION)

An order was always preceded by a quote requests and or design submittals. We considered this the final step before purchase.

Quote Submitters

Design Submitters

Price Inquiries

Goal: Automated reminders and urgency and late-chance incentives. Sales-assisted follow-ups (B2B)

FOCUS ON REPEAT ORDERS

I focused on driving long-term value by analyzing customer behavior across both audience segments using HubSpot, where we tracked purchases for over 24 months to track for seasonality.

about 15% of DTC buyers became repeat customerS

b2b ORDERS had roughly a 50% bulk-repeat rate

Because most purchases occurred during peak golf season, I structured cohorts by customer segment (DTC vs B2B) and acquisition channel (Meta, Google, LinkedIn, etc.), measured revenue starting from each customer’s first purchase.

This allowed us to measure true repeat behavior build the early stages of lifetime value despite seasonal spikes. For example, B2B buyers acquired via LinkedIn generated 3x more repeat orders over 2 seasons compared with DTC buyers from Instagram, which informed budget shifts and retention strategies like automated reorder reminders and sales outreach targeted lists.

WHY GOLF TOWELS?

With a defined, passionate audience, golf towels offered strong customization and repeat-order potential. Personalization delivered high perceived value at low production cost. Their niche appeal within golf creates built-in demand from individuals, courses, events, and corporate buyers alike.

REDUCING CUSTOMER ACQUISITION COSTS (CAC)

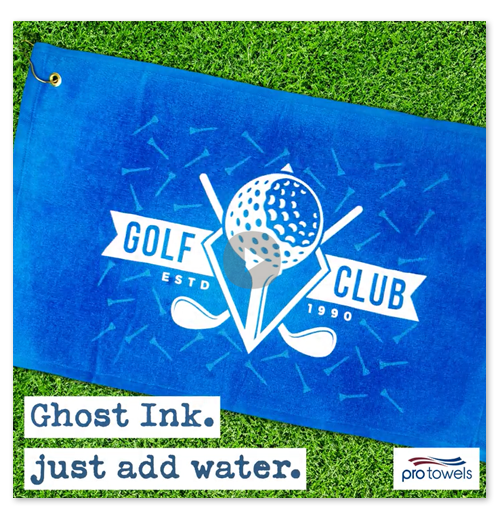

This was the first time we’ve run campaigns to these audiences so I used a mix of messaging, creatives, and formats (static images, carousel, videos, forms) to expedite our mission to optimize messaging and lower CAC. A huge contributor to this included Optimizing the Product Photo Library.

BY THE END OF THE CAMPAIGN, IT WAS COSTING US 15% LESS TO ACQUIRE THE SAME AMOUNT OF LEADS AT THE START.

As a graphic designer, I was able to create many of these ads myself and quickly replace poor performing ads or generate alternatives of the best performers.

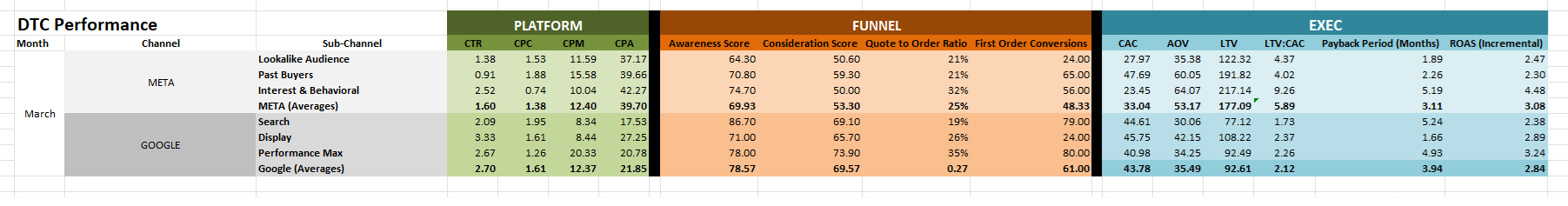

During the campaign, this is a sample of some of the metrics used to track performance. For most metrics I was establishing a baseline for these new audiences and markets. When I needed a benchmark for comparison (like incremental ROAS), I used data from previous business years to make the best estimate.

CORE METRICS

PLATFORM LEVEL

CTR

CPC

CPM

CPA

FUNNEL LEVEL

Quote:Order Rate

First Order Conversions

Reorders within 6 months

EXEC LEVEL

CAC

Average Order Value

Life Time Value (Benchmarks)

LTV:CAC

Payback Period

ROAS (Incremental)

EXAMPLE OUTPUT

Numbers have been changed and anonymized for this case study.

PERFORMANCE RESULTS

+ 0%

CTR IMPROVEMENT

Testing creative and refining audiences helped a lot here.

- 0%

CPA IMPROVEMENT

0%

QUOTE : ORDER RATE

We saw close to 78% for B2B Audiences, so DTC dropped the rate significantly. Which makes sense because of the amount of quotes for DTC vs B2B.

BUSINESS RESULTS

- 0%

COST PER AQUISITION

0

BENCHMARK LTV:CAC

Because these were new markets, we based LTV off of historic previous customers and made an estimated adjustment.

We considered success to be above 2.5.

0%

INCREMENTAL ROAS

KEY TAKEAWAY

There was a clear performance gap between DTC and B2B with B2B performing significantly higher in most areas. I based this off of higher intent, larger order values, and a better targeting ability.

LinkedIn Ads to the B2B Audience had the lowest CPM and highest CTR of all social channels. I feel strongly that LinkedIn can be a primary acquisition channel for B2B growth.

DTC Audiences did not convert as much as expected. Combined with a lower performing reorder rate; there were many questions lingering on how to improve DTC funnel performance.

Overall, more information is needed.

We saw some great wins in the two cycles of these campaigns. It became apparent very quickly that there is a very viable market for retailing to pro shops and country clubs. However, to achieve a more accurate LTV and before pivoting away from DTC, running a few more seasonal cycles to acquire more conversion data and core metrics would provide better insights.

TOOLS USED FOR THIS CASE STUDY

HUBSPOT MARKETING HUB

HUBSPOT SALES HUB

META ADS

LINKEDIN ADS

GOOGLE ADS

GA4

EXCEL

IN-STORE SALES DATA